Start Saving Big with USDA loan refinance for Qualified Homeowners.

Optimize Your Financial Flexibility: Advantages of Loan Refinance Explained

Loan refinancing provides a strategic chance for people seeking to improve their economic freedom. By safeguarding a lower passion price or readjusting car loan terms, borrowers can properly reduce month-to-month settlements and improve cash flow.

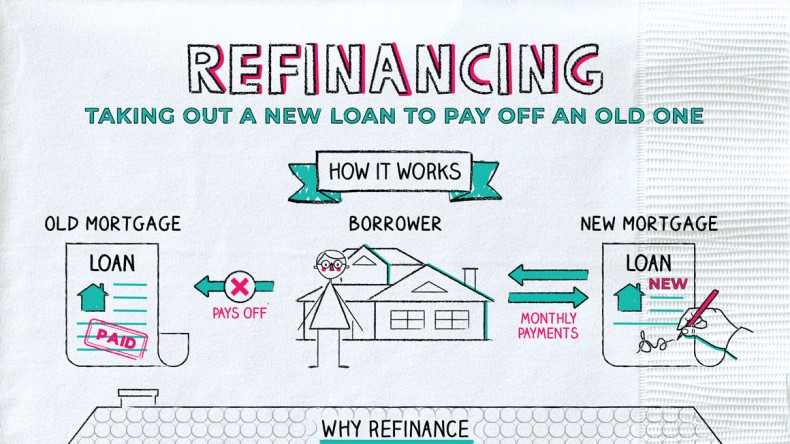

Comprehending Lending Refinancing

Recognizing funding refinancing is essential for homeowners seeking to enhance their financial circumstance. Finance refinancing entails changing a present home mortgage with a brand-new one, usually to attain better funding terms or conditions. This monetary method can be employed for various reasons, including changing the loan's period, modifying the sort of rate of interest rate, or settling financial debt.

The primary objective of refinancing is frequently to reduce monthly repayments, therefore enhancing money circulation. Homeowners may also refinance to access home equity, which can be used for considerable costs such as home renovations or education and learning. In addition, refinancing can use the possibility to switch over from a variable-rate mortgage (ARM) to a fixed-rate home mortgage, giving even more security in regular monthly repayments.

Nonetheless, it is crucial for house owners to assess their economic circumstances and the connected prices of refinancing, such as shutting expenses and fees. A complete evaluation can help identify whether refinancing is a prudent decision, balancing potential financial savings versus the first costs included. Eventually, comprehending finance refinancing empowers home owners to make enlightened decisions, enhancing their monetary health and paving the method for long-lasting security.

Reducing Your Passion Rates

Lots of homeowners seek to lower their rate of interest as a main inspiration for re-financing their mortgages. Reducing the rates of interest can substantially minimize regular monthly settlements and general borrowing prices, permitting people to allocate funds in the direction of various other monetary objectives. When rates of interest decrease, re-financing offers an opportunity to safeguard an extra desirable loan term, inevitably boosting monetary security.

Refinancing can cause considerable cost savings over the life of the finance (USDA loan refinance). Lowering a rate of interest price from 4% to 3% on a $300,000 home mortgage can result in thousands of bucks conserved in rate of interest settlements over 30 years. Furthermore, lower prices may make it possible for property owners to settle their car loans faster, therefore raising equity and minimizing financial debt much faster

It is crucial for property owners to assess their current home mortgage terms and market conditions prior to making a decision to re-finance. Evaluating prospective cost savings against refinancing prices, such as shutting fees, is important for making a notified decision. By capitalizing on reduced rates of interest, homeowners can not only boost their monetary flexibility but likewise create a much more secure economic future for themselves and their families.

Combining Debt Successfully

Homeowners often discover themselves handling multiple financial obligations, such as credit scores cards, individual fundings, and other financial commitments, which can bring about enhanced tension and challenging monthly payments (USDA loan refinance). Consolidating financial obligation effectively via financing refinancing provides a structured remedy to handle these economic burdens

By refinancing existing lendings into a solitary, a lot more manageable car loan, home owners can simplify their payment procedure. This approach not just lowers the variety of month-to-month repayments but can additionally decrease the general interest price, depending on market problems and specific credit rating profiles. By settling debt, homeowners can allocate their resources much more effectively, releasing up capital for crucial expenses or savings.

Changing Loan Terms

Readjusting finance terms can significantly affect a property owner's monetary landscape, particularly after combining present financial obligations. When re-financing a mortgage, debtors can change the length of the loan, rates of interest, and settlement routines, straightening them much more closely with their existing economic scenario and goals.

As an example, expanding the car check this loan term can decrease regular monthly settlements, making it simpler to handle capital. This may result in paying more passion over the life of the funding. On the other hand, going with a much shorter car loan term can cause blog higher month-to-month repayments but significantly reduce the complete passion paid, allowing customers to build equity faster.

In addition, changing the rate of interest can influence overall price. Homeowners might switch over from an adjustable-rate home loan (ARM) to a fixed-rate mortgage for security, securing lower rates, particularly in a beneficial market. Refinancing to an ARM can provide lower initial settlements, which can be useful for those expecting a boost in revenue or economic circumstances.

Improving Capital

Refinancing a home loan can be a strategic technique to improving money circulation, allowing borrowers to assign their funds much more efficiently. By securing a reduced interest rate or expanding the finance term, house owners can significantly reduce their month-to-month home loan settlements. This prompt reduction in costs can liberate funds for various other you could look here vital needs, such as repaying high-interest debt, conserving for emergencies, or spending in possibilities that can produce higher returns.

Additionally, refinancing can supply borrowers with the choice to transform from a variable-rate mortgage (ARM) to a fixed-rate mortgage. This shift can stabilize regular monthly settlements, making budgeting easier and boosting monetary predictability.

Another opportunity for enhancing money circulation is with cash-out refinancing, where house owners can borrow against their equity to access liquid funds. These funds can be made use of for home enhancements, which may boost home value and, subsequently, capital when the home is sold.

Final Thought

To conclude, lending refinancing offers a critical possibility to enhance economic liberty. By decreasing rates of interest, consolidating debt, changing car loan terms, and boosting cash money flow, people can achieve an extra favorable economic placement. This strategy not just simplifies repayment procedures however also advertises effective source appropriation, inevitably fostering lasting financial security and adaptability. Welcoming the benefits of refinancing can result in significant renovations in general monetary health and wellness and security.